Save GST on all Amazon Order with Business Account

Contents:

He also noted that when customer behaviour changed during the pandemic with working from home becoming more prevalent, companies had to procure and ship laptops to employees working remotely across the country. “Stepping up, we launched the ‘Bill 2 Ship 2’ service allowing customers to claim GST credit on their billing address for their pan India shipment,” Subhas added. In 2022, Reliance launched JioMartDigital to enable small electronics merchants to sell the entire product portfolio of Reliance Retail on an assisted selling model. Reliance Jio has also collaborated with Meta to launch an end-to-end shopping experience on WhatsApp. On acceptance of the offer, the loan is approved and the account is credited as disbursal.

In the last four years, we have added a host of features such as multi-users account feature to enhance account security and compliance, bulk purchase features, shared payment methods and business analytics tool. Compliance tools are necessary to direct and regulate wholesale online shopping. Filter and adjust your purchases adhering to your organization’s policies and enforce restrictions as per your needs to regulate and manage the wholesale purchase.

Make buying simpler

If the purchase cart value falls below ₹3,000 then such a transaction will not be eligible for the offer and the cashback amount will be deducted from the refund amount of such orders for the purpose of the Offer. Get access to deals and offers just for Business Prime members. Find out exactly how your customers feel about your brand by getting customer feedback.

All you have to do is check these offers before making the payment. You can also avail of discount on specific bank cards on EMI transactions. Some banks even offer no cost EMI options that save money on your transactions.

Elevate your organization with innovations that transform your B2B purchase processes. Improve your B2B purchase processes and drive efficiency across your organization.

You need to list your product details that you want to sell. Next section, you will need to add basic seller information i.e tell us about your business, address, landmark and so on. The author writes about fintech, banking, and future of SAAS services.

More business tools, greater value for your B2B buying process

Under this, you can start your trial membership for 30 days and decide if you want to purchase it accordingly. However, you will have to give your card details to avail of the benefits. Third-party seller services – The Company receives a substantial portion of its revenue from third-party sellers, from commissions and any related fulfilment and shipping fees and other third-party seller services.

10 Benefits Of Using A Credit Card – Forbes Advisor INDIA – Forbes

10 Benefits Of Using A Credit Card – Forbes Advisor INDIA.

Posted: Wed, 03 May 2023 13:15:53 GMT [source]

Sell bulk to businesses and reach thousands of GST-verified business customers. Set pricing for large quantities of goods so you can sell in bulk all over India, and get support for the input tax credit, shipping, and fulfillment. The sale typically includes a wide variety of products such as office supplies, industrial equipment, janitorial supplies, and more.

You can use the earned cashback for your future purchases. Every time you earn some cashback, you can avail of it for the next purchase. This way the actual cost of your order will be minimized and you can get discounts on every order you place on the platform. Easebuzz also offers fraud detection and prevention features, which can help protect businesses from fraudulent transactions.

What can you buy on Amazon Business?

Increased responsibility – Responsibility of managing inventory, packaging & shipping may be overwhelming for some sellers. The company also launched a mobile app to make it easier for customers to place orders and track their shipments. It is also working on various programmes, like Digital Kendra, to help MSMEs with their digitisation and enable local players from smaller cities to trade online.

This was a fantastic help and no “hear say” like a number of the other articles and feedback had. It was very difficult to decide whether to mix or not or see the reason why I would accept the “enterprise free offer”. Select the Manage GST option under the Business setting. GST numbers will be visible there, and the administrator will be able to add or delete them.

Uncover the insights that can help you improve retention, inspire loyalty, and drive business growth. Business purchasing solutions like advanced analytics and spend management tools that work for you and simplify your B2B purchase processes. Turn wholesale purchasing into a value driver for your organization by getting the required support to serve your unique and ever changing needs. Technology fees – Seller Flex program requires the seller to pay ‘Technology fees’ at Rs. 10/order. Additional IT cost – The seller needs to have label printers, UPS inverter, etc. Stores all the inventory in Sellers locations, where seller has to keep dedicated inventory for seller flex.

Bulky/heavy products across all regions are charged Rs. 26. You will need to add your Company/Business Name and accept the seller agreement. Submit online application filling all the details sought. It also lowers logistic costs, purchase costs and improves employee productivity. Everyone is aware of the fact that the platform announces major sales throughout the year.

Seller is pined with the Prime badge & products become eligible for unlimited free 1-day & 2-day delivery options. Receive GST invoice and claim the input tax credit, with every business purchase on select products. This growth will be driven primarily by new online shoppers from smaller cities and the continued migration of crucial categories such as fashion and grocery to online platforms. We’re already seeing a shift towards quick and instant delivery options within the grocery category. In fashion, “social” commerce and direct-to-consumer brands are gaining market share.

Offers:-

These sales include Republic Day Sale, Holi Sale, Summer Sale, Independence Day Sale, Great Indian Festival, Diwali Sale, and Christmas Sale. You have access to their entertainment services such as Prime Video and Prime Music. Submit the required information to complete the registration process. Instant payout on selling shares, with the ICICIdirect Prime Account. We are always available to address the needs of our users. All other members can view the details and don’t have an editing facility.

- Earlier there were different types of taxes for different stages of manufacturing, sales and purchase.

- Upload any supporting documents that may be required, such as a copy of your GST registration certificate.

- Next section, you will need to add basic seller information i.e tell us about your business, address, landmark and so on.

- Some banks even offer no cost EMI options that save money on your transactions.

Refer to the table below to get an idea of the tentative dates of sales in 2023. Apply and get rewards worth Rs. 1,700 and get Rs. 150 cashback and additional rewards worth Rs. 1,550. The mobile video edition of Prime membership costs Rs. 599 annually. Build and protect your brand, creating a better customer experience.

Overall Structure of Goods and Services Tax in Amazon Business

Buyers can save on their purchases by availing of input tax credits of up to 28% on purchases made for office equipment, office supplies etc. Additionally, Business Prime members have access to guided buying for employees. Guided buying allows administrators on the account to set preferred suppliers and products and restrict employee capabilities when it comes to placing orders.

Govt widens Aadhaar ambit: 22 pvt firms can use it to verify customers – The Indian Express

Govt widens Aadhaar ambit: 22 pvt firms can use it to verify customers.

Posted: Fri, 05 May 2023 23:13:41 GMT [source]

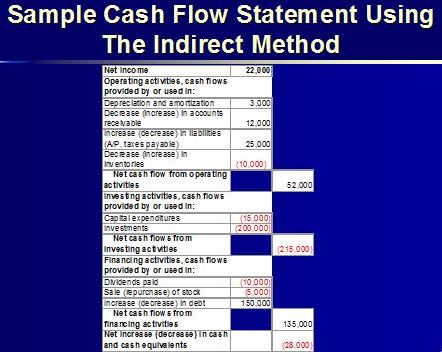

GST was introduced on the principle of “one nation, one tax”. Earlier there were different types of taxes for different stages of manufacturing, sales and purchase. This multiplicity of taxes has caused numerous problems and led to cascading taxes. Goods and Services Tax is a tax system implemented by the government of many countries, including India, to simplify the tax system and make it more efficient.

We started using amazon business account benefits india across our whole IFFCO group for Travel and Expense Management as one of the key aspects to keep control on spends. It was a challenge to manage employee spend and expense reporting across our multiple office locations with disparate solutions. We found Zoho Expense as a very powerful and flexible tool which allows us to accommodate many different expense policies and compliances in respect to many different countries’ regulations.

Learn how Zoho Expense helps with your expense tracking, management, and reimbursement. 24 years old Early Childhood (Pre-Primary School) Teacher Charlie from Cold Lake, has several hobbies and interests including music-keyboard, forex, investment, bitcoin, cryptocurrency and butterfly watching. Is quite excited in particular about touring Durham Castle and Cathedral.

Impact of predictively profit loving big tech layoffs on job seekers & stuff – The Tech Panda

Impact of predictively profit loving big tech layoffs on job seekers & stuff.

Posted: Fri, 05 May 2023 17:09:48 GMT [source]

At Lendingkart, the process is fully online – from application to sanction and disbursal. The following simple steps complete the loan application process. Get help growing your business with a paid service that includes a dedicated account manager.

Customers can join a Business Prime Shipping annual membership based on the number of customers their enterprise account has, with memberships starting from $179 to $10,099 per yr. Option to choose from various sellers at competitive prices. It is a newly introduced indirect tax regime launched in India in 2017. The main aim was to replace existing tax systems like VAT, Service tax, Excise, etc.

Under Manage GST, all the details of the registered GST number and address will be available. After you validate your GSTIN Number or Business PAN number, you can submit and then it will take around 24 hours for your application to be validated. You’ll be asked to enter the email you want to use for your account.