Top 7 Best Exchanges for Buying Cryptocurrencies with Fiat

Contents:

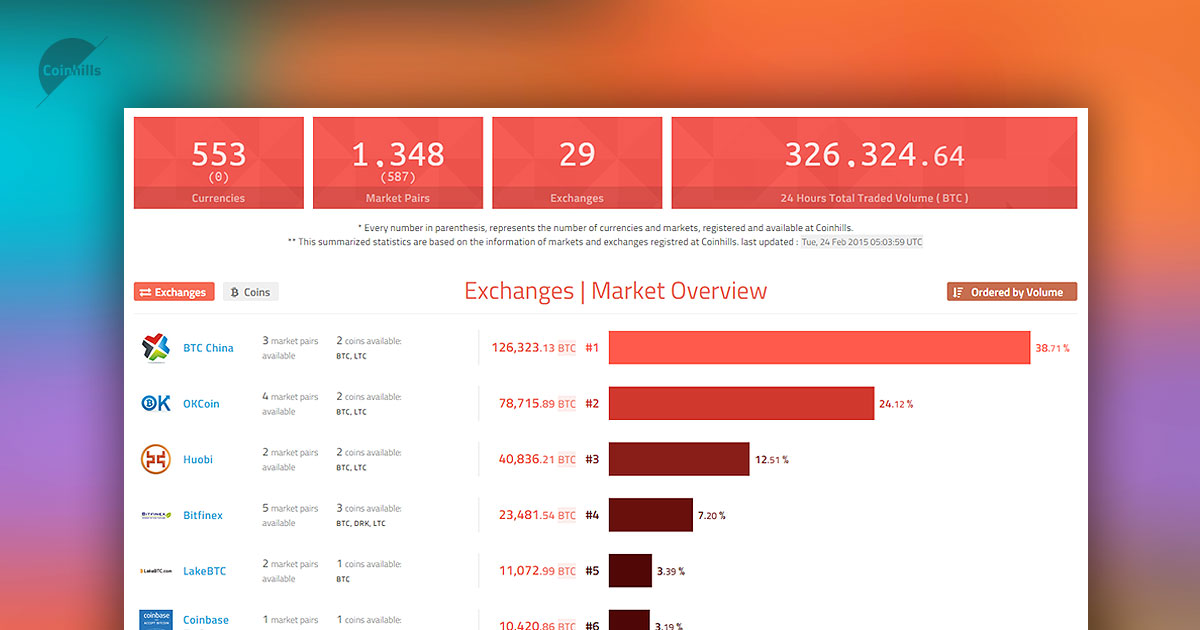

While new Bitcoins are created through mining, existing ones can be purchased by using fiat currencies on a cryptocurrency exchange. The most-traded national currencies for Bitcoin are the U.S. dollar, the South Korean won, the Japanese yen, and the European Union’s euro. Due to government regulations, the Chinese yuan holds 0% of the market share of currencies traded for Bitcoin. This includes money in circulation such as paper money or coins. Fiat money is backed by a country’s government instead of a physical commodity or financial instrument. This means most coin and paper currencies that are used throughout the world are fiat money.

- It gets its value based on the trust people place in the authorities that issue it.

- Popular examples of fiat currencies include the euro, Japanese yen, US dollar and pound sterling.

- Although you can trade anonymously, you must verify your account to activate fiat transfers.

- Therefore, fiat money is easy to use to settle transactions in all locations.

- Most modern paper currencies are fiat currencies, including the U.S. dollar, the euro, and other major global currencies.

what is gala money is the opposite of commodity money, which is money that’s based on a valuable commodity, a method of valuation that was used in the past. As the world continues to push forward into new frontiers, one thing is almost certain – digital currencies and digital assets will continue to play a larger role. A cryptocurrency wallet is a software program that stores your cryptocurrency keys and lets you access your coins. Bitcoin and other cryptocurrency investments are not protected by insurance from the Securities Investor Protection Corp. .

Fiat Money

It has tangible value because of the demand for gold in jewelry and manufacturing in addition to the resource’s scarcity. Other safe currencies include the Japanese yen, United States dollar and Swiss franc. Japan and the United States both have strong positions in the global economy that ensure their currencies will bounce back from economic hardship quicker than other countries. Switzerland’s neutrality in global conflicts, low debt levels and strong monetary policies make the franc a safe haven currency.

Hyperinflation—extremely fast and out-of-control inflation—caused the currency to lose its value. The government began printing banknotes with higher values to keep up with inflation. The country’s central bank had to stop printing money, causing the Zimbabwe dollar to officially lose value in the foreign currency market. The country eventually turned to the U.S. dollar as its base currency. Because it can no longer be converted into gold and is not directly tied to the amount of gold a government stores, fiat money is at risk from inflation. This means it can lose its value in the face of economic uncertainty.

https://cryptolisting.org/ money is subject to the effects of inflation, during which time it may lose its value in the global markets. Fiat money is both physical money and legal tender and is backed by a nation’s government. Alternatively, you can open a demo account and practice trading fiat currencies. Although you can trade anonymously, you must verify your account to activate fiat transfers.

Depending on where you were in the world, various commodities were used as currency. In colder regions, furs and pelts were the standards, while in warmer areas, these were less likely to be as valuable as food or other minerals. It wasn’t an exact science, and value tended to be mostly based on the necessity and availability of certain items. It’s a piece of paper created by the government that has value because everyone involved agrees that it means something. If nobody believed in what was printed on the paper, it would not have any value at all.

The gold standard is a system in which a country’s government allows its currency to be freely converted into fixed amounts of gold. Inflation is a decrease in the purchasing power of money, reflected in a general increase in the prices of goods and services in an economy. Experts suggest the currency lost 99.9% of its value during this time. Prices rose rapidly and consumers were forced to carry bags of money just to purchase basic staples.

Examples of representative money include checks and credit cards. Typically, representative money is a placeholder when the user intends to pay at a later date. Like fiat money, representative money does not have intrinsic value. Its value is instead derived from the financial institutions that uphold it.

How to Use Google Pay to Buy Crypto – MUO – MakeUseOf

How to Use Google Pay to Buy Crypto.

Posted: Wed, 19 Apr 2023 07:00:00 GMT [source]

These are just three of many examples of fiat currency found throughout the world. Legal tender means that the money is backed by the full faith and credit of the government that issues it. For instance, the use of gold, grain, and even furs and other animal products as commodity money preceded the current fiat system.

What is Fiat Money?

BudgetSmart.net and any content or offers listed herein are not an intermediary, broker/dealer, investment advisor, or exchange and do not provide investment advice or investment advisory services. However, the formal severing of the connection between gold and the U.S. dollar occurred in 1971. President Richard Nixon formally ended the convertibility of dollars to gold, leaving the dollar without an underlying commodity.

But that insurance doesn’t protect individual customers from password theft. The process is largely the same as setting up a typical brokerage account. When an investor creates an account on Coinbase, they must provide their identification. If they send it to another wallet, it can still be traced back to the Coinbase purchase connected to the account holder’s identity. Individuals can create multiple public addresses and distribute their collection of bitcoin over many addresses.

Falling prices can be disastrous for producers, especially if they happen quickly. This can result in big economic shocks, forcing companies to cut costs, lay off workers, or take other actions to stave off losses in a deflationary environment. And thatcan lead to a domino effect, hurting more businesses as they lose customers or their customers spend less, leading to more cuts and job losses. Currency convertibility is the degree to which a country’s domestic money can be converted into another currency or gold. The currency of Europe, the Euro, ranks fourth on the list with a 2.9% market share in trading Bitcoin. Japanese regulators were also some of the earliest adopters and among the most accommodating of the virtual currency.

How does fiat money work?

Money then enables enterprises to develop and societies to establish new expertise, thus fostering a sort of dynamic progression toward the future. For example, before there was money, anyone who owned land produced their own necessities and traded the surplus with other people for the things they needed. Wholesale CBDCs are used for transactions between banking institutions. On the other hand, retail CBDCs facilitate the transfer of funds between consumers. More than sixty stablecoins with a market cap exceeding more than 130B USD. Frequent crypto traders and transactors will recognize the top coins – USDT, USDC, BUSD, DAI, UST, and TUSD, which collectively make up more than 96% of total stablecoin market capitalization.

They purchase these currencies with their local fiat currency just as they would buy shares through a brokerage. If Bitcoin is increasingly accepted by all genres of businesses—from local coffee shops to large corporations—that could help fuel the adoption of it as a virtual currency. Before making a purchase, some people may compare whether they are better off paying for an item in fiat currencies or in Bitcoins. You can purchase Bitcoin and other cryptocurrencies using fiat currencies on a cryptocurrency exchange. Established financial institutions will be happy to transact in CBDC, putting faith in the security of the private blockchain and the fact that a country’s government backs the CBDCs of interest.

While the majority of cryptocurrencies are decentralized, all CBDCs are centralized – managed, controlled, and owned completely by the currency’s issuing government and/or monetary authority. To buy bitcoin, you must select an appropriate service or venue, connect with a payment method, place an order, and ensure stable storage for purchased cryptocurrency. Each of these steps requires research and a careful assessment of the pros and cons of the relevant service. Bitcoin is available at bitcoin ATMs or from payment services like PayPal and mainstream brokerage firms like Robinhood or Coinbase. The user of an online or hot wallet isn’t the holder of the private key to the cryptocurrency that is held in it.

Fiat vs. Representative Money: An Overview

For example, a business dealing with mobile phone assembly can buy new equipment, hire and pay employees, and expand into other regions. Fiat money is currency backed by the government that issued it and isn’t tied to a commodity such as gold. Bitcoin, the first and most valuable cryptocurrency, generally has its value determined by the market logic of supply and demand. There’s a finite supply of Bitcoin that’s governed by its underlying software, so when demand goes up, so do prices. Because most cryptocurrencies aren’t backed by central banks, they derive their value from different sources.

However, in principle, Bitcoin can replace fiat currency on its properties alone. Bitcoin was originally meant to be a peer-to-peer payments mechanism, but it has morphed into something different. One of the key differences between representative currency and fiat currency is that governments could only print money according to the amount of actual gold they had in their vaults. Technically, each one of these notes was at one point redeemable for the amount of gold they represented. Each country had a different currency with a value that was determined based on their own gold reserves and their prices for the metal.

NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments. Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy.

It just requires an account at a service or an exchange, and a way to store your purchases safely. Although P2P exchanges don’t offer the same anonymity as decentralized exchanges, they allow users the chance to shop around for the best deal. Many of these exchanges also provide rating systems, so that users have a way to evaluate potential trade partners before transacting. A hardware wallet is typically a USB-drive device that stores a user’s private keys securely offline. Such wallets have advantages over hot wallets because they are unaffected by viruses that could infect one’s computer.

The fee-per-trade is a function of the currency amount of the trade, and, naturally, the higher the trade amount, the higher the fee. In contrast, you can trade thousands of cryptocurrencies on Coinbase, and as of 2022, traditional brokers like Fidelity Investments began to include bitcoin investing for 401 accounts. Credit card processing can tack on extra charges to such transactions. In addition to paying transaction fees, there may be processing fees that the exchange may pass onto the buyer.

In particular, CBDCs are effectively programmable money, which means that governments could create money that digitally expires. Bitcoin and cryptocurrency wallets are a place to store digital assets more securely. Keeping crypto outside the exchange and in a personal wallet ensures that investors have control over the private key to the funds. An exchange wallet is offered, but not recommended, for large or long-term cryptocurrency holdings. At most exchanges, you can connect your bank account directly or you can link it to a debit or credit card.

This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. Any references to historical price movements or levels is informational based on our analysis and we do not represent or warranty that any such movements or levels are likely to reoccur in the future. The safest fiat currency is often considered to be the Norwegian krone because Norway has zero debt. Norway’s own economy is also quite stable compared to other countries. However, those conditions do not make the krone immune to inflation or bubbles.

References to FOREX.com or GAIN Capital refer to StoneX Group Inc. and its subsidiaries. Gold is still traded today for fiat currency as a way to store wealth or speculate on the changing value of both. Learn more about gold and silver and how they are traded with fiat currencies. Bitcoin is not a fiat currency because it is not issued by a government or regulated by a central authority. Instead, Bitcoin and other cryptocurrencies are backed by blockchain technology. Cryptocurrencies like Bitcoin are decentralized, meaning no single authority controls their supply or value.

The company has run into a slew of regulatory issues in the US and worldwide because of its in-house coin, Tether, and because of its staunch resistance to regulation that compromises user privacy. Started in 2015 specifically to make buying Bitcoin easier and safer, it’s a New York trust company, regulated by the New York State Department of Financial Services . It’s quickly gained authority, being one of the few exchanges trusted by the BlockTower Capital hedge fund. Raising that limit to $25,000 requires an additional government-issued ID card, verified proof of residence, your Social Security number, and a selfie of you holding the ID you used for verification. Unlike Coinbase, Bitstamp will also withdraw to your debit card, though the fee schedule is complex.

A private currency managed by the masses has appeal for those that are skeptical of the central banking system or the regimes in their countries. Linking your debit card, credit card, or bank account is one of the easiest ways to buy Bitcoin and more than 100+ cryptocurrencies. Perhaps one of the most noticeable differences between CBDCs and a traditional cryptocurrency is decentralization.

What is a Bitcoin ATM, and how do you use one? – RateCity

What is a Bitcoin ATM, and how do you use one?.

Posted: Mon, 01 May 2023 05:37:10 GMT [source]

The US Treasury Department prints money, and the Federal Reserve, the nation’s central bank, controls how much money is circulating. Hardly any of the money that changes hands in a modern economy is backed by anything tangible. In fact, most transactions today don’t even involve handing over paper and coins. Worries about inflation and government control over money and economic policy have led many people to consider cryptocurrencies.